It’s a battle lots of people face. And it’s a battle that very few people have been equipped for in the modern world. School doesn’t prepare you for it, most often your parents or peers don’t prepare you either. Unfortunately, we ultimately fall into the same trap; the debt trap. That’s when you think; debt consolidation is the answer! And there are free debt consolidation programs out there, however the problem isn’t the cost of the program, it’s the cost of the exercise itself.

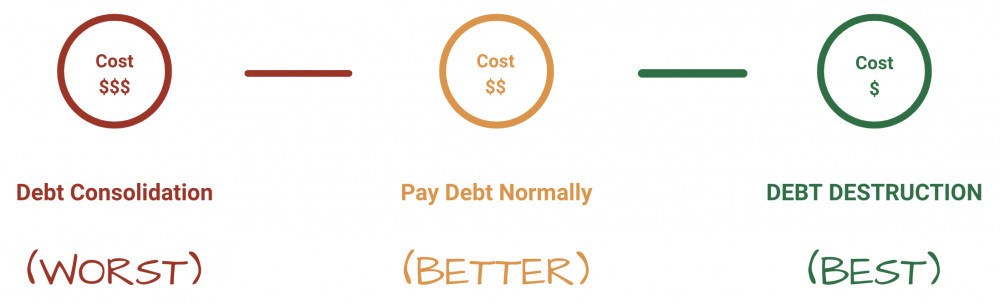

Debt consolidation is good for one thing; cash flow. If cash flow is more important than the overall cost of debt, then debt consolidation could work for you. However, if you are able to keep your head above water (metaphorically speaking), then there’s a better alternative; Debt Elimination (or as I like to call it, Debt Destruction).

Does Debt Consolidation Save Me Money?

No, rarely.

Like I said above, debt consolidation can save you when it comes to cash flow, however inevitably it costs you more in the long run.

Most people look to consolidate debt via their home mortgage, as this presents the most affordable payment solution. Plus with interest rates generally lower than personal loans and credit cards, it’s bound to be cheaper, surely?

Wrong.

Mortgages span a much longer time frame than loans, for example. And even though the interest rate on the mortgage looks more attractive, compound interest over a term of 25 to 30 years adds up to a lot.

Let’s take an example of a 15,000 loan bearing interest at 12.5% over a 5 year term. Now say you decided to move that loan into your mortgage at a rate of 3.5% over the 30 year term of the mortgage. The loan repayments would be 337 per month, compared with the 67 per month additional payment going the mortgage route. The mortgage is so much cheaper!

Not really.

Over the life of the mortgage, you’re paying a total of 24,248 and 9,248 in interest (24,248 less 15,000 loan). With the loan, you’re paying a total of 20,248 and 5,248 in interest (20,248 less 15,000 loan). That’s 4,000 less in interest by NOT consolidating your debt into your mortgage – a 43% saving! And that’s BEFORE even applying the Debt Destruction method!

How Do You Achieve Debt Elimination?

OK, so debt consolidation isn’t cheaper, it just looks cheaper. What’s the alternative?

Paying your debts in their current form.

Nothing mind shattering about that, is there? Well, yes and no – there’s one tweak you need to make.

Assuming that you are still able to afford to pay your debts and you’re not paying out more than you bring in, leaving the debts as they are and the applying the Debt Elimination Method can shave years (and plenty of interest) off of your obligations.

Debt Destruction Method – How Does It Work?

OK, enough of the hype, let’s get into how it works. This method I first learnt from John Cummuta, and if you apply the dedication and self discipline, it will serve you very well.

There are 3 steps to the Debt Destruction Method;

1. Calculating an Accelerator Payment

2. Ranking your debts by payoff period

3. Systematically pay-off your debts

Calculating Your Accelerator Payment

As I mentioned earlier; this method will work for you extremely well but you need to find some surplus money each month that you can pump into your debts to accelerate paying them off.

If you have no spare money, look harder. What can you cut out, what frivolous expenses can you get rid of to increase your disposable income? How badly do you want to be out of debt?

Once you’ve got the number, that amount needs to be allocated every month as an additional debt payment, your accelerator payment.

Ranking Your Debts By Pay-Off Period

Take your debt committments and list them, including the balance still owed and the monthly minimum payment.

Now, divide the outstanding balance by the minimum payment – this will give you the number of months left in order to payoff the debt.

Now you need to rank the debts by LEAST number of months remaining, with the lowest ranked as number 1 (i.e. the lower the number of months, the better the ranking).

Generally, your mortgage will always be ranked last.

Here’s an illustrative example:

| Debt description | Balance | Min. Pmt | Months left | Ranking |

| Personal loan | 5,000.00 | 220.00 | 23 | 1 |

| Car loan | 10,000.00 | 350.00 | 29 | 2 |

| Store card | 750.00 | 20.00 | 38 | 3 |

| Credit card | 3,000.00 | 60.00 | 50 | 4 |

| Mortgage | 250,000.00 | 900.00 | 278 | 5 |

Systematically Pay Off Your Debts

Now, you need to take your accelerator payment and add that to the payment for the number 1 ranked debt (i.e. shortest remaining term).

Religiously overpay this debt with the normal payment plus the accelerator payment. You will now be able to eliminate this debt even quicker.

As soon as that debt is paid off, you allocate that entire payment (previous loan payment plus accelerator payment) against the next debt.

Using the example above: The personal loan has a minimum payment of 220 per month and say that you can afford to pay an additional 200 every month towards your debts (your accelerator payment), you’ll pay that debt down by 420 every month. Once this debt is cleared (much sooner than the original term), you move that entire 420 to the next debt – the car loan. The car loan has a minimum payment of 350 per month, you now pay 770 (350 minimum payment plus the 420 personal loan payment and accelerator payment). Repeat until all your debts are settled.

Don’t spread the additional payment over many debts! Focus it on one at a time and super-charge the pay-off period.

And do not miss payments on the other debts; this will only sabotage your efforts and result in credit issues, penalties and charges and other undesired repercussions.

Get the Book

Like I mentioned, I first came across this method when reading John Cummuta’s book, Transforming Debt Into Wealth some years back.

It goes into a lot of detail and is a worthwhile read.

In Summary

If you can afford it, accelerate it. Compound interest can work for you and against you. Unfortunately, by trying to consolidate your debts into different products, you always end up paying more long term. By applying the Debt Destruction Method, you will save not only a lot of interest, but a lot of time too.

![]()

Wow-what a great post and an eye-opener. I have never heard of the term debt destruction but it is close to what I heard of the method of paying down the debt that is easiest. I think this is a great way to help get your finances in order. Thanks for sharing!

Hi Melissa,

Thanks for the message! I kinda gave it the name Debt Destruction, but you can call it what you like – the ultimate goal is to destroy that debt 🙂

Glad you found this helpful.

All the best,

Gareth

Thanks for this post. I am not sure where I learned this method before, but I used it to eliminate debt earlier in life.

Thank you for bringing it back to my attention so I can teach it to my daughter.

I don’t know how this slipped my mind. It was so easy to do before.

You are correct that there always is money in your budget that you can direct in other ways besides getting the morning donut or the expensive coffee. This money may seem very little, but it adds up.

Pennies make cents?

Hi Greg,

That’s so awesome – it’s great to have feedback from others who this system has worked for! Thanks for your comment 🙂

And enough cents make dollars!

Cheers,

Gareth

I love the logic of it it really makes it into a step by step formula for clearing debts. Might have to change the way I organise my debts from now on. Thanks for the advice.

Hey Kevin,

It’s definitely a game changer. Plus, it’s also the psychological boost it gives you once debts start melting away.

Best of luck!

Man, that is extremely powerful. I see your point of view. I was thinking the other way is better, but technically it’s really not. Great read!

Thanks AJ, appreciate the feedback. It’s crazy how powerful these processes can actually be!

Hi Gareth,

Great post. I have been digging myself into deeper debt because of health insurance, car insurance, car lease ending next month. One year ago my debt was totally manageable but all my bills were raised and your post made me decide to take some drastic action. I will now attack my debt with laser like focus by attacking one debt at a time maximizing my payments and bringing my debt down as quick as possible.

Thanks,

Courtney-

Hey Courtney,

I’m sorry to hear things have gotten a bit challenging, but am so glad to hear that the article has inspired and assisted you!

I’d suggest checking with your lease provider too if there’s a lump sum that can be paid to keep the car instead of handing it back? That way, if you can afford it, you can keep the car and not have to worry about entering into a new lease for a new vehicle. Worst case, you can finance that lump sum payment with a loan, but then eliminate it as soon as possible with this method.

All the best.

Gareth

This is great! School do not teach financial issues like this and I think they should. I am at the age where my friends are entering full time jobs and it is clear some are buying anything they want and not managing their money properly. This post can help a lot of people! Thanks again.

Hey Brian,

I know, it’s a sad reality. Feel free to share this with them before to help them avoid the pitfall. Avoiding debt is much better than trying to pay it down quicker!

Cheers,

Gareth

This is super good and very helpful! We are still paying of a lot of debt and it’s such a burden. I am going to share this with my husband, because a life without a debt is truly a better life.

I like how you explained everything so well. Even I can understand it. 🙂 Usually I shy away from money stuff, but this makes a lot of sense to me.

Hi Manuela,

Thank you, I’m really glad you found the information valuable – wishing you all the best in destroying that debt!

Best wishes.

Gareth

I don’t have any debt, but friends of mine do. I will share this with them. I love the idea of using the excelerator debt. Great suggestion. Thank you.

Hey Catherine,

That’s awesome to hear; prevention is better than cure!

THanks for sharing.

Gareth

This is brilliant and it’s really going to help so many people, consolidating your debt is the number 1 thing you automatically think is the best thing to do but when you actually break it down like you just did it’s amazing how much more you will actually end up paying!

I think your debt destruction method is genius! thanks for the information, definitely buying the book!

Amy

Hi Amy,

Thanks for the message and kind words – wishing you all the best!

Gareth

Debt Consolidation is something very commonly used by people and has been for as long as I remember, you have pointed out some very good information on how to manage your debts for the best results. I found this article very useful, and I am sure many other people will benefit from reading your article as well.

Jeff

Hi Jeff,

Thanks for the message, glad you found it helpful! 🙂

Gareth

Great and informative post on debt consolidation. I never knew of this term before. I’ve learnt so much from this and I am sure many more people will benefit from it and make the right choices to become debt free. Your recommendation of book looks really good too.

Great job as always

Hey Habib,

Thanks for stopping by; appreciate the kind words!

Gareth